Terra Demise Directed Insolvency; Bitwala Relaunching Services

- 1 Bitwala, earlier known as ‘Nuri’ relaunched its services backed by Striga.

- 2 The crypto exchange filed for insolvency in August 2022, and returned users’ funds.

- 3 At a time Bitwala was in collaboration with Celsius Network for remaining annual interest on Bitcoin.

Bitwala, formerly known as Nuri, is coming in a new avatar. In 2022, the digital assets exchange ceased its operations and returned funds to the consumers. The exchange is planning to relaunch its operations.

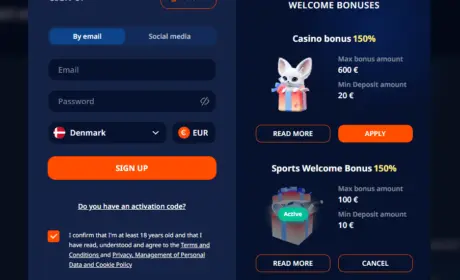

For relaunching its services, Bitwala joined forces with Striga, a banking giant. The agreement between both the firms states that Striga will provide Bitwala ‘Banking and Crypto-as-a-service’.

In August 2022, Nuri filed for insolvency, the rebranding process of the brand occurred in 2021. It is believed that the motive behind filing for insolvency was the stir in the crypto market at that time due to the collapse of TerraLUNA.

As per the last update, the overall user base of Bitwala was 500,000, it is believed that the firm has a pre-constructed user base which might help it to expand in a short time.

Bitwala partnership with Striga has solved the major barrier that was faced by the exchange. The bank will provide an infrastructure which can be used by the exchange without worrying about any regulatory burden.

Following the collaboration of Bitwala and Striga, exchanges website started offering service to trade crypto assets such as Bitcoin, Ethereum using Euro as a payment mode.

Bitwala became famous after its partnership with the now bankrupt Celsius network. The motive behind the partnership was to provide annual interest on Bitcoin in 2020.

Victims of Terra & FTX Crisis Re-Entering Market?

Terra collapse is one of the most troubling events that dragged the crypto industry a few years back, and the collapse largely affected the budding companies. Millions of dollars went missing from the market in just a few days.

Similarly, in the FTX incident, around $200 Billion went out of the market pushing several companies into insolvency.

After both the events, a major decline in crypto adoption, usage and trading using centralized crypto exchanges was observed. Recently, Sam Bankman Fried was convicted for all seven charges including wire fraud among others.

Following the recent court’s hearing on the FTX case, the crypto market showed bullish momentum as Bitcoin crossed the milestone of $35k for twice last month. Market analysts believe that positive sentiments in the market arose due to SBF’s conviction.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Source