news Archives - Blockchain Casinos

- 1 In the weekly time frame, the crypto market showed significant growth as Bitcoin crossed the $35k mark.

- 2 The weekly gainers list is topped by PancakeSwap as its price surged more than 77%.

- 3 BTC trading volume grew 31.68% in the intraday time frame.

In the weekly time frame, prices of majority of cryptocurrencies grew significantly and Bitcoin crossed the much awaited resistance of $35k. The surge has been largely attributed to the recent conviction of SBF.

Following the Terra decline, a significant decline was observed in the market and since then, till the beginning of 2023, the crypto market was bearish. In the past 7 days, BTC prices grew 3.03%.

In the 24 hours time frame, the entire crypto market capitalization rose 1.55% and when writing, it was $1.34 Trillion. Bitcoin trading volume has shown a significant growth of 31.68% in the intraday time frame.

However, the weekly gainers list is topped by PancakeSwap as its price surged more than 77% and at press time, it was trading at $2.15. The 2nd rank in weekly gainers list is held by Trust Wallet Token (TWT).

One to fifth rank in weekly gainers list is captured by penny coins and tokens and a major improvement in memecoin trading price was also observed in the past few weeks.

Terra collapse is one of the most troubling events that dragged the crypto industry a few years back, and the collapse largely affected the budding companies. Millions of dollars went missing from the market in just a few days.

Limited Losers in Weekly Frame

The weekly loser list has only 9 coins. Monera (XMR) price slipped and lost 3.27% of its trading value in the weekly time frame.

Huobi Token (HT) is the second weekly loser. HT fell 1.99% through the week. The weekly losers list seems to be empty as the tokens/coins declined and lost a nominal portion of their trading price. ‘

The positivity in crypto market is luring investors and on other hand, institutional investors are helping the crypto industry expand. Most recently, DZ Bank of Germany also confirmed its entry in the crypto industry as it launched a crypto custodian platform.

If this positivity remains in the market, then there are possibilities of future surge in trading price and trading volume. A severe boost in the registration of crypto projects and crypto related products has surged significantly since the opening of 2023.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Source

- 1 Bitwala, earlier known as ‘Nuri’ relaunched its services backed by Striga.

- 2 The crypto exchange filed for insolvency in August 2022, and returned users’ funds.

- 3 At a time Bitwala was in collaboration with Celsius Network for remaining annual interest on Bitcoin.

Bitwala, formerly known as Nuri, is coming in a new avatar. In 2022, the digital assets exchange ceased its operations and returned funds to the consumers. The exchange is planning to relaunch its operations.

For relaunching its services, Bitwala joined forces with Striga, a banking giant. The agreement between both the firms states that Striga will provide Bitwala ‘Banking and Crypto-as-a-service’.

In August 2022, Nuri filed for insolvency, the rebranding process of the brand occurred in 2021. It is believed that the motive behind filing for insolvency was the stir in the crypto market at that time due to the collapse of TerraLUNA.

As per the last update, the overall user base of Bitwala was 500,000, it is believed that the firm has a pre-constructed user base which might help it to expand in a short time.

Bitwala partnership with Striga has solved the major barrier that was faced by the exchange. The bank will provide an infrastructure which can be used by the exchange without worrying about any regulatory burden.

Following the collaboration of Bitwala and Striga, exchanges website started offering service to trade crypto assets such as Bitcoin, Ethereum using Euro as a payment mode.

Bitwala became famous after its partnership with the now bankrupt Celsius network. The motive behind the partnership was to provide annual interest on Bitcoin in 2020.

Victims of Terra & FTX Crisis Re-Entering Market?

Terra collapse is one of the most troubling events that dragged the crypto industry a few years back, and the collapse largely affected the budding companies. Millions of dollars went missing from the market in just a few days.

Similarly, in the FTX incident, around $200 Billion went out of the market pushing several companies into insolvency.

After both the events, a major decline in crypto adoption, usage and trading using centralized crypto exchanges was observed. Recently, Sam Bankman Fried was convicted for all seven charges including wire fraud among others.

Following the recent court’s hearing on the FTX case, the crypto market showed bullish momentum as Bitcoin crossed the milestone of $35k for twice last month. Market analysts believe that positive sentiments in the market arose due to SBF’s conviction.

Disclaimer

The views and opinions stated by the author or any people named in this article are for informational ideas only and do not establish financial, investment, or other advice. Investing in or trading crypto or stock comes with a risk of financial loss.

Source

- 1 Worldly governments are leveraging digital twins to solve complex problems.

- 2 People could be spending more time in the metaverse by 2030.

A new report suggests the United States should nurture their extended reality (XR) development or they stand a chance of falling behind globally in promoting it. XR is an immersive technology consisting of mixed reality (MR), augmented reality (AR), and virtual reality (VR). All of them are an integral part of the metaverse.

Time to Move On

XR Association, a metaverse trade group, discusses in their report dubbed “Reality Check: Why the U.S. Government Should Nurture XR Development”, the importance of these technologies in driving economic growth. United States allies have already moved beyond its basic utility, gaming.

The technology is likely to become a multi-billion market by the decade’s end. Some US agencies foresee the benefits of the metaverse technology. The report writes, “It has also been designated a critical technology by both the National Science and Technology Council and the Department of Defense (DoD) because of its importance to national security and the economy.”

Despite the government’s acknowledgment of XR’s significance, the nation is still behind the curve. According to the study, “the United States has thus far not developed a strategy or institutional structure to nurture the XR sector. This failure puts the U.S. at a significant disadvantage and stands in contrast to other nations.”

Findings of the report assert that the government’s devised strategy for betterment using technology inspires actions from public and private sector investors. Countries like the U.K., China, South Korea, and more are already leveraging the technology to grow.

“The U.S. can learn from what other governments are doing to support innovation, protect users from harm, and build trust and predictability as the technology changes over time,” the study suggests. It also adds that the White House and Congress are collaborating on technological advancements to “build trust and provide predictability.”

Worldly governments are leveraging digital twins, virtual replicas of something existing in the real world, to solve complex problems. XR Association recommends the Congress to “empower U.S. government agencies to model how digital twins can be leveraged by the government to serve the public interest.”

According to KPMG International, one of the Big Four accounting firms, people could be spending more time in the metaverse by 2030. The company writes, “People will be applying for jobs, earning a living, meeting with friends, shopping, even getting married using the virtual capabilities of the metaverse.”

Nearly 400 Million users are using metaverse today, and half of them are aged 13 years old or below.

Source

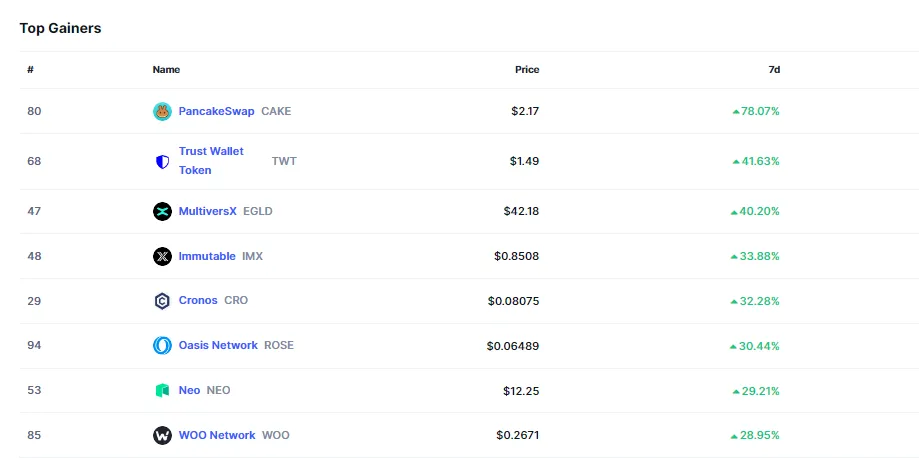

- 1 Liquidation-to-production ratio among public miners dropped to 70 percent during the summer.

- 2 Some analysts predict BTC may reach $60K by the end of 2023.

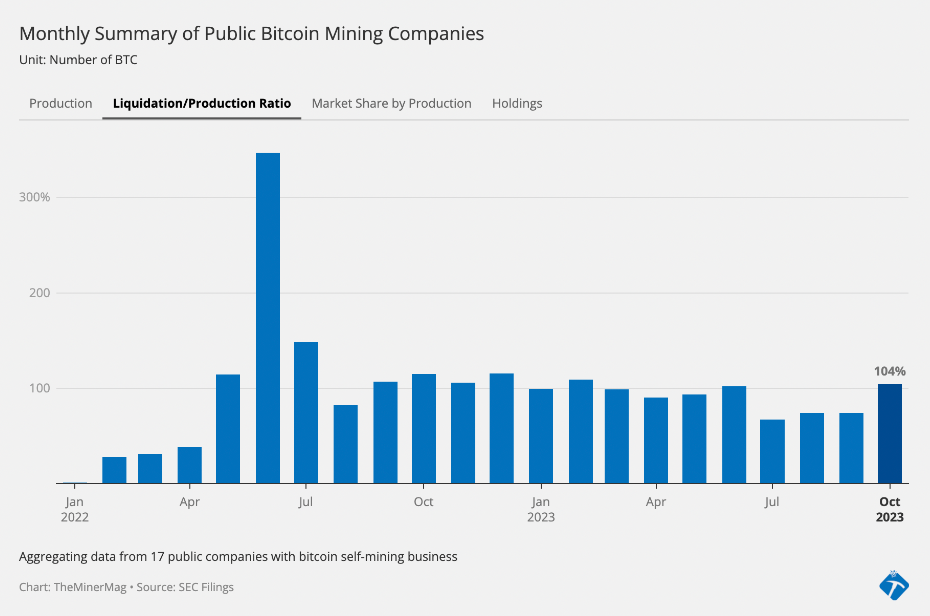

Last month brought joy to several crypto miners as they pocketed $164 Million in profits. Data from the crypto data portal, The Miner Mag shows leading Bitcoin (BTC) miners sold 5,492 BTC following the price surge in the asset. Recently, the flagship currency has been on a rising spree since mid-October, adding nearly 40 percent to its price.

Marathon Digital Again Tops a List

The liquidation/production ratio shot up by 104 percent. However, the report highlights aggregator BTC liquidation-to-production ratio among public miners has dropped to 70 percent during the summer. The list of companies selling their holdings includes Marathon Digital Holdings, Hut 8 Mining, CleanSpark Inc., and more.

This excludes companies like Riot Platforms, HIVE Digital Technologies, Northern Data, and more as they have not yet updated details regarding their Bitcoin liquidations. Riot Platforms is currently the biggest crypto miner operating in the United States.

Marathon Digital tops the list with 1.2K BTC sold followed by Core Scientific and CleanSpark with 910 and 633 BTC respectively. The latest study by crypto data aggregator CoinGecko shows that Marathon has the most Bitcoin in its holdings. The companies in the list hold over 38K Bitcoin collectively.

Some analysts predict BTC may reach $60K by the end of 2023. However, it has to stick around $31K. Many hold positive sentiments for Bitcoin but market conditions may play out differently. Events such as the collapse of Terra Luna ecosystem and FTX waned investor interest in the market last year.

Bitcoin ETFs may instigate a price surge in BTC. However, that may shift the balance of power to the investing big boys like BlackRock, Fidelity, WisdomTree, and more. Approval from the US lawmakers would provide the investors facing regulatory barriers regarding crypto investment exposure to the crypto asset.

Sentiments towards the crypto market are essential as they determine profitability potential for the future. A possible increase can lead crypto mining companies to enhance their operations to add more BTC to their portfolios. However, it also adds their name to the environmental debate.

Environment-friendly countries are less likely to allow crypto mining operations given the amount of energy the activity consumes. Some states in the US including Arkansas and Kentucky have seen backlash from communities over pollution concerns. Meanwhile, activists in Texas alluded to the potential exploitation of Navarro County resources attributing to the development of a Bitcoin mine.

The US accounts for a majority of the crypto mining hash rate. Although the development of a situation similar to China in 2021, where the nation banned all crypto-related activities, is unlikely, regulators are still skeptical about allowing a larger room for the industry in the nation.

Source